Tourists from Great Britain can claim refunds on IVA for tax free shopping in Spain, that means up to a 21% refund on goods purchased for your own use back home, subject to any personal allowances.

By Nick Nutter | Updated 22 Mar 2023 | Andalucia | Living In Andalucia |

Login to add to YOUR Favourites or Read Later

Tax free shopping is about the only benefit to come out of Brexit for the GB tourist to Andalucia yet only about 10% of tourists are claiming their refunds. Tell your family, friends and relatives in Greast Britain. For any purchase of items in Spain (excluding the Canary Islands), that are taken back to Great Britain, the purchaser is entitled to a refund of the IVA (equivalent to VAT in the UK), typically at the moment (2021) 21%. That means a discount on every purchase of jewellery, clothing, fashion accessories, electronics – all types of products, made whilst the visitor is in Spain.

Tax free shopping is about the only benefit to come out of Brexit for the Great British tourist to Andalucia yet only about 10% of tourists are claiming their refunds. The main reason for this low take up of this permanent discount is lack of awareness - hence the message in the first paragraph. Stores such as El Corte Inglés are heavily promoting tax free shopping. More good news is that there is no limit as to the value of the purchase, subject to personal allowances.

If you reside in England, Scotland or Wales (Great Britain) and visit Europe for less than 6 months,– you can claim an IVA refund on your purchases! However, there are rules around what you can and cannot claim. Goods which are not used or consumed on your trip will qualify – think fashion items, cosmetics, jewellery, technology and yes, your wine too. On the other hand, restaurant bills, hotel bills, train tickets, gas bills or alcohol you've already drunk will not qualify. If you're planning to stay in the EU for a bit longer, also make sure you keep an eye on your purchase time, as the right to claim a VAT refund expires at the end of 3 months after the date of your purchase. For example, if you are leaving in April (anytime between 1st - 30th April), the earliest date you can make a purchase and reclaim IVA on it is 1st January.

For once with Spanish bureaucracy, the reclaim procedure is not rocket science.

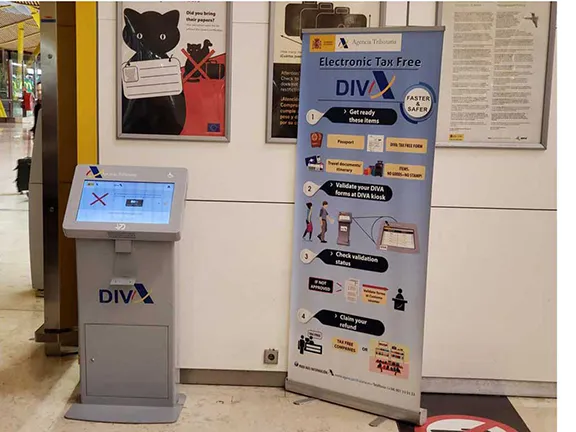

To claim a refund of IVA on purchases made in Spain, you need to fill in a tax-free form (the DIVA form) in the shops where you buy your purchases. This document lists all the items you want to claim an IVA refund on.

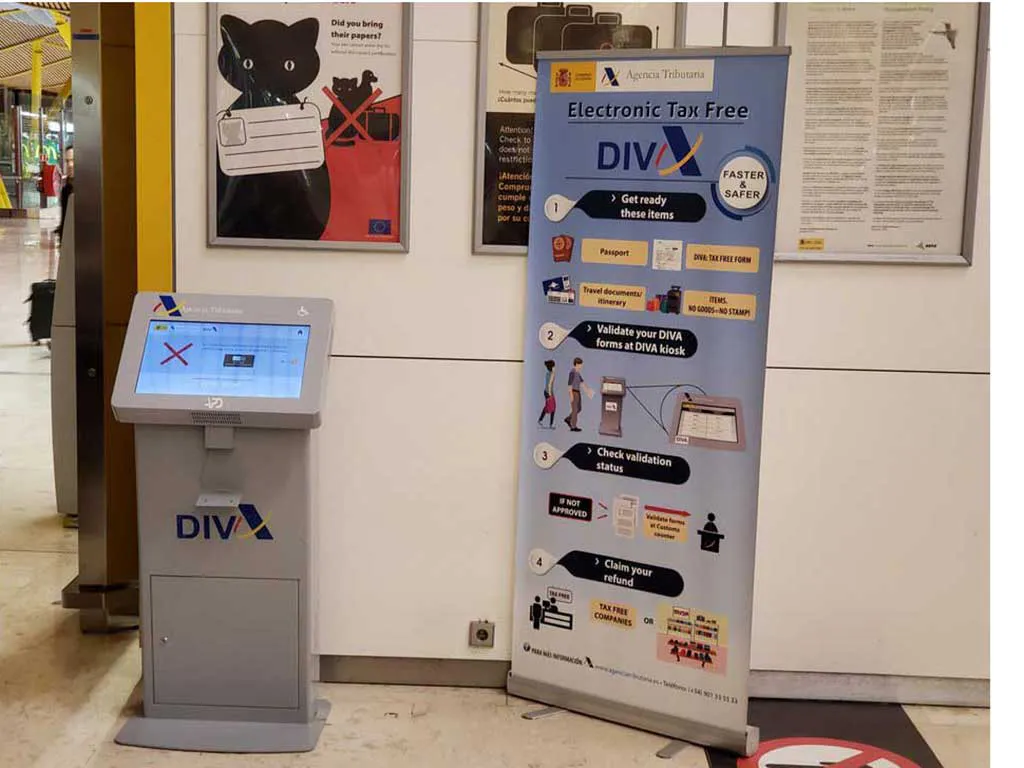

This form needs to be validated at customs within three months of the purchase date. Some stores, including El Corte Inglés, offer an electronic IVA refund procedure (DIVA). These forms can be validated directly at automatic terminals installed in Spain’s main ports and airports. If there is no DIVA terminal, the document needs to be validated by a Spanish customs officer. In Andalucia, there are DIVA terminals at Malaga airport and the ports of Algeciras and Tarifa.

As for paper forms, these must be validated by customs officials before you leave the EU. If your form is not validated, the goods will be considered as not having left the EU, and therefore, not eligible for a tax refund.

If you are departing to another country in the EU, you will not be able to reclaim IVA in Spain. You will have to do this in the last customs point before leaving the EU.

- Directly through the shop where you made the purchases. They will refund the entire amount within 15 days by cheque, bank transfer, or to your credit card. Basically, you have to post the DIVA forms back to the shop unless the purchase is made at a shop at the airport.

- Through the Tax Free management body located where you are departing (a fee will be charged). The refund will be in euros, in cash, to your credit card, by cheque, or by bank transfer.

The companies listed below are authorised by the Tax Agency to refund IVA to travellers. You will find their machines once you are through security:

- Global Blue

- Tax Free shopping. Planet

- Innova Taxfree Spain

- Comercia Global Payments

- Tax free El Corte Inglés

- B Free! Tax Back

- Travel Tax Free

So there you have it, tax free shopping.

The UK government has brought the rules for duty free shopping in line with the rest of the world. The amount of duty-free that passengers can bring back with them has also been significantly increased for all destinations.

You can bring some goods from abroad without having to pay UK tax or duty, if they’re either:

- for your own use

- you want to give them as a gift

Personal Allowances For England, Scotland and Wales

- 42 litres of beer

- 18 litres of still wine

- 4 litres of spirits OR

- 9 litres of sparkling wine, fortified wine or any alcoholic beverage less than 22% ABV

- 200 cigarettes OR

- 100 cigarillos OR

- 50 cigars OR

- 250g tobacco OR

- 200 sticks of tobacco for heated tobacco products

- £390 or £270 if travelling by private plane or boat

Download an informative leaflet