Learn about the Impuesto sobre Bienes Inmuebles (IBI) tax in Spain, a municipal tax that property owners must pay annually based on cadastral value. Discover how the tax is calculated, when it must be paid, and its importance as a revenue source for Spanish municipalities.

By Nick Nutter | Updated 20 Apr 2023 | Andalucia | Living In Andalucia |

Login to add to YOUR Favourites or Read Later

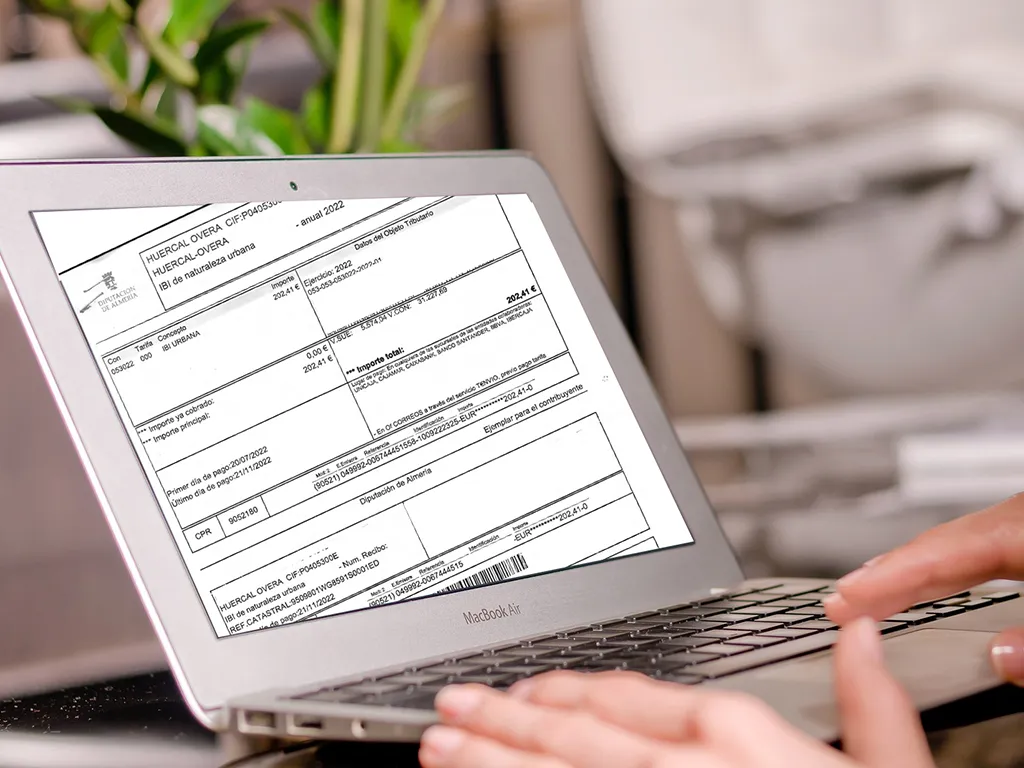

Understanding the IBI Tax in Spain

The Impuesto sobre Bienes Inmuebles (IBI) is a tax levied on property owners in Spain. It is a municipal tax, which means that it is collected by the local government rather than the national government. The IBI tax is one of the most important sources of revenue for Spanish municipalities, and it is used to fund local public services such as education, healthcare, and infrastructure. In some parts of Spain, for instance Alicante, it is known as SUMA, Suma Gestión Tributaria. SUMA being the name of the office that collects the tax.

The IBI tax is based on the cadastral value of the property, which is a value assigned to each property by the Spanish Tax Agency based on factors such as location, size, and amenities. The cadastral value is updated periodically to reflect changes in the market value of the property. The tax rate for the IBI tax is set by each municipality and can vary from one municipality to another. IBI should be between 0.4% and 1.3% of the cadastral value. The amount of IBI paid on comparable properties differs widely throughout Andalucia depending on the location of the property.

The cadastral value is used as the benchmark to calculate all other property related taxes on your property.

Every property owner in Spain pays either IBI or SUMA.

Either your local town hall or SUMA office will collect your payment. In Andalucia, the tax is known as IBI and is paid to your local town hall.

Property owners in Spain must pay the IBI tax annually. The tax is usually paid in two instalments, one in June and one in November. The amount of the tax depends on the cadastral value of the property and the tax rate set by the municipality.

Yes, you will. However, it is important to know that often, Spanish local authorities will not chase you up at once if you miss an instalment. Instead, the council will hold a record against your property that will come to light when you want to sell or bequeath it. That is why a fairly hefty retention is kept by the purchaser’s solicitor when you sell your property, to pay any outstanding IBI bills and fines imposed.

It is important for property owners in Spain to pay the IBI tax on time to avoid penalties and interest charges. Failure to pay the tax can result in fines, and in some cases, the local government may even seize the property.

The IBI tax is deductible from Spanish income tax, which means that property owners can reduce their taxable income by the amount of the tax paid. This deduction can be particularly beneficial for property owners who rent out their properties, as they can deduct the IBI tax from their rental income.

The easiest way to find out the cadastral value of your property is to go to your local town hall armed with the 20 character cadastral reference that you will find on the Nota Simple and Escritura (deeds) relating to your property. They will also tell you the amount of IBI due each year.

When the seller of a property is non-resident in Spain, the buyer’s solicitor must withhold 3% of the sales proceeds and pay it into the Spanish Tax Office. Non-resident sellers may be entitled to a tax rebate on the 3% withheld (subject to criteria) if up to date with the taxman.

In recent years, the IBI tax has become a controversial issue in Spain. Some property owners have criticized the tax for being too high, particularly in areas where property values have increased rapidly in recent years. Others have called for the tax to be reformed to make it more progressive, so that those with higher incomes and more valuable properties pay a larger share of the tax.

Despite these concerns, the IBI tax is still an important source of revenue for Spanish municipalities. It is a key way for local governments to fund public services and infrastructure, and it helps to ensure that property owners contribute to the cost of providing these services. While there may be debates about the fairness of the tax, it is likely to remain a fixture of the Spanish tax system for the foreseeable future.